Calculate How To Price Your Staffing Services

Our pricing resources help you get it right. Learn how to calculate staffing bill rates, set competitive markups, and protect your margins with clear pricing formulas.

Recruitment Agency Bill Rate, Markup, Fees & More

So you’ve started a staffing firm or are thinking about starting one. Now, what should you be charging customers to keep competitive and still make a profit? Use the profitability calculator to determine staffing and recruitment Agency Bill Rate, Markup, Fees & More.

Calculate Your Profitably Now

Why Getting Pricing Right Matters for Staffing Firm Profitability

Pricing impacts everything: your ability to scale, cover overhead, and compete in tight labor markets. Mispriced services lead to lost bids, poor cash flow, and eroded gross margins. Understanding burden rates, markups, and industry benchmarks helps you avoid costly mistakes – and gives you the confidence to quote rates that win and sustain your business.

How to Price Your Staffing Firm Services

Owning a staffing firm can be profitable, but only if you know what to charge your customers. Charge too much; you might lose contracts to your competitors. Too little, and you are undervaluing your services and cutting into your profit margin. Striking the right balance is key and a big challenge for this competitive industry.

To succeed in your staffing business, you need a comprehensive understanding of pricing and everything that goes into it. To get you started, we have laid out some basic pricing terminology and definitions, as well as a sample profit assumption to help determine your bill rate.

Pricing correctly is a difficult balance to strike, so we’ve compiled a few simple points to keep in mind. For a more in-depth look into pricing, download the free How To Price Your Staffing Services whitepaper.

Factors That Influence Your Bill Rate (Beyond Pay + Markup)

Pricing isn’t just pay rate plus a standard markup. Consider:

- Industry-specific risk: Healthcare, industrial, and IT each carry different burden assumptions, credentialing requirements, and fall-off risks that impact your pricing.

- Market demand and candidate scarcity: Tighter markets require higher pay rates and often higher markups to attract talent.

- Client contract terms: MSP/VMS fees and longer payment terms (Net 45–90) directly affect profitability and cash needs.

The Components of Pricing

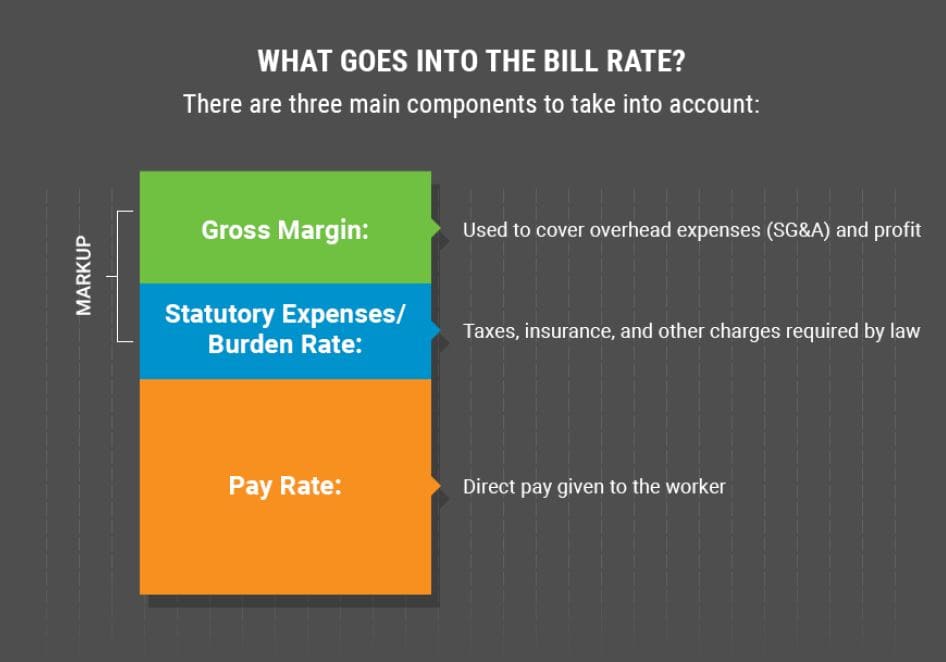

Bill rate is the rate a company pays to a staffing agency for the services of a temporary worker. There are several components of pricing to take into account when figuring out your bill rate.

Many different factors go in to pricing out your staffing firm services, so in this whitepaper we will discuss the major components in order to help you determine a fair rate to charge your clients while keeping your business in the black.

Gross Margin

The amount of money a staffing firm gets to keep after paying the temporary workers’ payroll, benefits, payroll, and other statutory expenses. Gross profit margin dollars are used to pay internal overhead costs and the owner’s profit.

Burden Rate or Statutory Expenses

Taxes, insurance, and other charges required by law. For staffing firms, it includes:

Federal Unemployment Tax (FUTA)

Unemployment taxes paid to the Federal government. The FUTA rate is 6.0% with a wage base of $7000, and employers can take a credit of up to 5.4% of taxable income if they pay state unemployment taxes. If you qualify for the highest credit, then the minimum FUTA rate is .6%.

Social Security and Medicare Tax Rate (FICA)

A single flat fee/ rate to all employers of 6.2% for social security and 1.45% for Medicare tax. This is capped at a salary of $137,700 for Social Security for each employee in 2020. There is no cap on Medicare tax.

State Unemployment Insurance Tax (SUTA)

Rates and taxable wage limits vary significantly from state to state. And Worker’s Compensation Insurance.

Worker’s Compensation Insurance

An insurance policy that covers work-related injury and illness. Workers comp insurance rates vary by skill type, vendor, and stat.

Markup

A percentage charged by the staffing firm on top of the pay rate. Markups can include various factors; statutory expenses, overhead and operating costs, and profit. Operating expenses can cover rent, equipment, recruiting fees, commissions, and more.

Pay Rate

The pay rate is the direct pay given to the worker and makes up the majority of the bill rate.

Profit Margin

A measure of profitability is calculated by taking net profit (revenue-cost) and dividing it by revenue.

Real-World Examples of How Costs Add Up in Different Industries

Pricing isn’t a one-size-fits-all in staffing. Different industries mean different costs. Consider for example:

- Industrial staffing: Higher Workers’ Comp rates increase burden. Plan a higher markup to maintain margin.

- Healthcare staffing: Credentialing, background checks, and rapid response add overhead and fall-off risk. Remember to factor these into markup.

- IT staffing: Higher pay rates with typically lower Workers’ Comp. Pricing strategy often focuses on tighter operations and competitive but disciplined markups.

Learn more about our staffing and recruitment payroll tax services and solutions.

What Is The Average Staffing Agency Markup?

What do staffing agencies charge? The average staffing agency markup for temporary employees or independent contractors can range anywhere between 20 – 75%. Permanent placement markups are typically 10 – 20% of the employee’s gross annual salary.

Benchmarking Your Markup Against Industry Standards

What is standard pricing in your industry, and how do you stay competitve? Here are a few actions to consider:

- Adjust for contract size, specialty, location, risk profile, MSP/VMS fees, and payment terms.

- Research local competitors and your niche to understand typical pricing by role and geography.

- Compare your markup to industry averages to ensure you remain competitive and profitable.

Calculating A Profitable Scenario

Let’s say you have an administrative assistant on assignment who has a pay rate of $15. Assume your burden rate is 12%. Assume your mark-up is 50%.

The formulas you need are as follows:

- Bill Rate = Pay rate * (1+Mark-up)

- Direct Cost of Labor = Pay rate * (1+Burden rate)

- Gross profit margin = Bill Rate – Direct Cost of Labor

Now let’s put the numbers into the formulas:

- What is your Bill Rate? – $15 * (1+.5) = $22.50

- What is your Direct Cost of Labor? – $15 * (1+.12) = $16.80

- What is your Gross Margin? – $22.50 – $16.80 = $5.70 per hour

The $5.70 hourly gross margin is what you have as a staffing company to cover your overhead and your net profit.

How does mark-up affect gross margin?

Markup affects gross margin by increasing the amount a staffing agency earns over the worker’s pay rate. The higher the markup, the larger the difference between the bill rate and the direct labor cost. This difference contributes to the agency’s gross margin, which covers operating expenses and profits. Essentially, the higher the markup, the more room the staffing agency has to maintain profitability while covering costs like taxes, insurance, and overhead. A well-set markup ensures a healthy gross margin for the business.

Let’s take the same example and calculate using a 30% markup rather than 50%.

$15 * (1+.3) = $19.50

Your direct cost of labor stays the same: $15 * (1+.12) = $16.80.

What is your new gross margin?

Changing your markup from 50% to 30% has a significant impact on your gross margin. ($2.70/hr compared to $5.70/hr)

Common Pricing Mistakes New Staffing Firms Make

Here are some common pricing mistakes to avoid as a new staffing firm owner:

- Forgetting to include recruiter commissions, technology, and admin overhead in markup calculations.

- Underestimating burden costs and netting far lower margins than expected.

- Using the same markup across all clients instead of adjusting for risk, industry, and contract terms.

Try The Staffing Profitability Calculator

PER HOUR

TOTAL CONTRACT

The right funding starts with people. That’s us. Experts dedicated to the staffing industry and talented people who make it work.

Considerations Beyond Pricing

When starting a firm, we think there are four key things you must consider:

- People

- Technology

- Insurance

- Payroll Funding

The people you hire are by far your most important asset, and sound technology infrastructure is critical. For a new firm, you will need various insurance policies such as Worker’s Compensation. Finally, you’ll have to secure the appropriate working capital. Startup temporary staffing businesses have significant and immediate cash flow needs. It’s up to you to figure out which financing option works best for your goals.

How Client Contracts Impact Profitability (Hidden Cost Drivers)

Contracts can hide cost drivers in plain sight – if you know what to look for. Consider these:

- Discounts, rebates, guaranteed fill rates, and penalties can significantly impact margin and should be modeled before you sign.

- Longer payment terms (Net 45–90) increase your working capital needs and cash risk.

- MSP/VMS fees reduce your effective markup and must be included in your pricing model.

When to Adjust Pricing for Existing Clients

To know when to adjust pricing, here are some keys to remember:

- Revisit markup when client requirements increase (screening, onboarding, credentialing).

- Review burden rate changes annually (SUTA, workers’ comp, FICA caps).

- Adjust pricing when candidate pay rates rise in competitive markets.